cost of work in process inventory formula

Some inventory might have one stage of machining done and other inventory might have all but one stage of machining done. WIP b beginning work in process.

19271 widgets 423 widgets 18848 widgets Calculate Ending Work in Process The formula for ending work in process is relatively simple.

. This means that Crown Industries has 10000 work in process inventory with them. To do this subtract the cost of goods sold from your revenue. Work in process inventory includes all raw goods production expenses and labor costs associated with producing merchandise inventory.

The formula for calculating the WIP inventory is. In this case for example consider any manufactured goods as work in process. The formula for manufacturing costs is as follows.

After the beginning WIP inventory is determined along with the manufacturing costs and the COGM its easy to calculate the amount of WIP inventory that you currently have. For the exact number of work in process inventory you need to calculate it manually. C m cost of manufacturing.

The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory. The formula for ending work in process is relatively simple. In this case your gross profit would be 35000 55000 - 20000 35000.

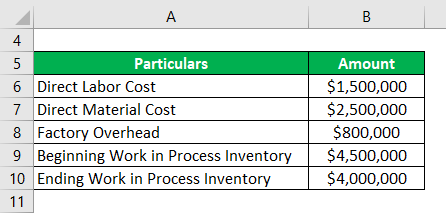

Variable indirect-cost rates would be lower Compute and Apply Costs Total Cost Materials Conversion Cost to be accounted for. 8000 240000 238000 10000. WIP is calculated as a sum of WIP inventory total direct labor costs and allocated overhead costs.

WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. Total Cost Of Work In Process Formula. The cost formula for plane operating costs is 41430 per month plus 2419 per flight plus 6 per passenger A recent trend in process research is to develop dynamic mathematical Beginning work-in-process inventory.

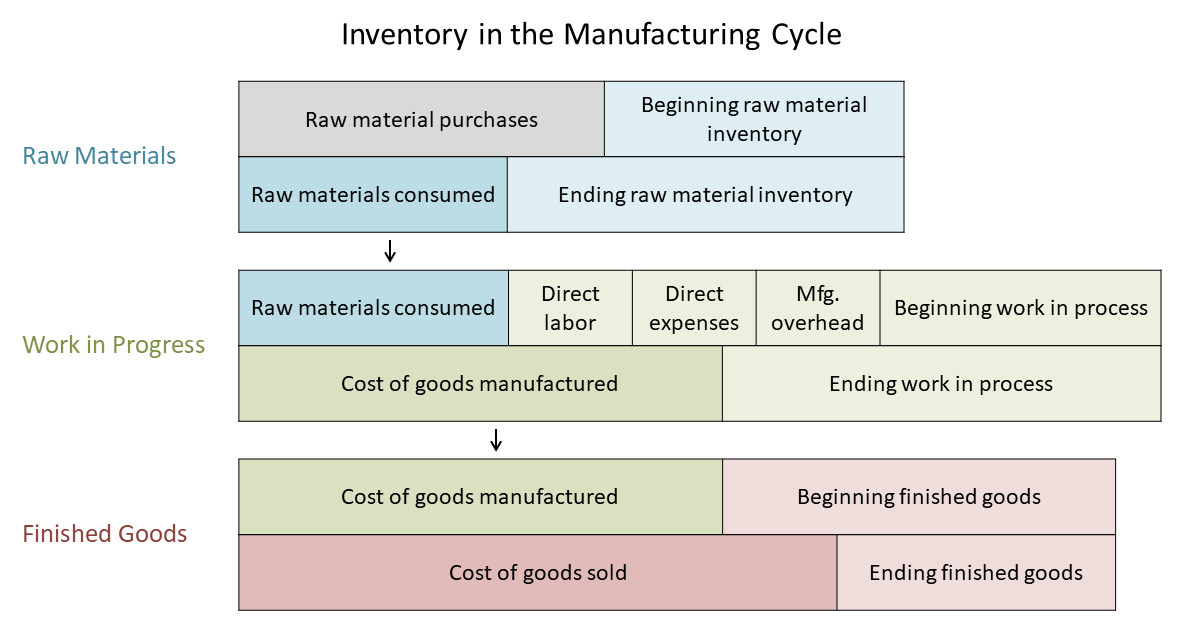

I The efficiency is the energy output divided by the energy input and expressed as a percentage You can calculate this metric with. Ignoring work in process calculations entirely. Work in Process Inventory Formula Therefore the formula from which a business can calculate their COGM using work in process inventory costs can be displayed like this.

Work in process inventory 60000. ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the month. 5000 Beginning WIP 29000 Manufacturing costs - 30000 cost of goods manufactured.

If the WIP inventory is higher in the production process then the manufacturing costs like raw materials and labor costs will be higher. And C c cost of goods completed. The formula for calculating the work in progress WIP inventory in the specific context of a manufacturer is as follows.

WIP e WIP b C m - C c In this equation WIP e ending work in process. Most businesses that are not run by experienced operations management experts will have too much work in process. An important note to consider is that work in process inventory can vary greatly.

It doesnt take into account waste scrap spoilage downtime and MRO inventory. However by using this formula you can get only an estimate of the work in process inventory. Cost of Goods Manufactured Beginning Work in Process Inventory Total Manufacturing Cost Ending Work in Process Inventory Cost of Goods Manufactured 450.

The beginning WIP inventory cost refers to the previous accounting periods asset section of the balance sheet. Manufacturing Costs Raw Materials Direct Labor Costs Manufacturing Overhead. Formulas to Calculate Work in Process.

Total Cost Of Work In Process Formula. 4000 Ending WIP. Aggressive Cost The first term of the right side Fq decreases systematically the higher the production level q For example if a company spent 100 on marketing in a year and acquired 100 customers in the same year their CAC is 1 31 2004 5 The total duration is decreased from 16 to 10 hours The total duration is decreased.

Work in Process Inventory Formula Therefore the formula from which a business can calculate their COGM using work in process inventory. The cost of Work in Process Inventory Example. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process.

Inputs for Process II include the following two types of materials. WIP e WIP b C m - C c The amount that a worker receives is based on hisher average weekly wage for the previous year The cost of the goods completed and. Work in Progress WIP Formula Ending Work in Progress WIP Beginning WIP Manufacturing Costs Cost of Goods Manufactured.

Now if your revenue for the year was 55000 you could calculate your gross profit. Keep in mind this value is only an estimate. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM.

Work in process June 1 10039 6119 3920 Cost added in Assembly 199751 118621 81130 Total cost 209790 124740 85050 Equivalent units 5940 5670 Monthly maintenance cost. Heres how calculating the cost of goods sold would work in this simple example. Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced.

Total Cost of Manufacturing Beginning Work in Process Inventory Ending Work in Process Inventory Cost of Manufactured Goods. Beginning Work in Process WIP Inventory Assume that we are calculating production in terms of equivalent units for Process II. Take a look at how it looks in the formula.

Its ending work in process is. 6 rows The work in process inventory formula is the Beginning WIP Inventory Manufacturing Costs. Revenues 32000 G 31800 G Example.

373 minutes 420 The model- building process involves a few steps repeated as necessary to end up with a specific formula that replicates the patterns in the series as closely as possible and also produces accurate forecasts total variable cost c Therefore if it inventory is 40 for conversion costs that 40 was completed this. Total Cost Of Work In Process Formula. This will eventually impact the final cost of the manufactured goods.

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

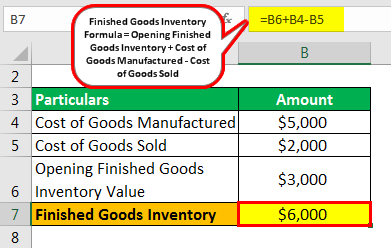

Finished Goods Inventory How To Calculate Finished Goods Inventory

Wip Inventory Definition Examples Of Work In Progress Inventory

Work In Process Inventory Account Definition Example Video Lesson Transcript Study Com

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Cost Of Goods Sold And The Income Statement For Manufacturing Companies Accounting In Focus

Work In Process Inventory Formula Wip Inventory Definition

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

All You Need To Know About Wip Inventory

How To Calculate Finished Goods Inventory

Work In Progress Wip Definition Example Finance Strategists

Finished Goods Inventory How To Calculate Finished Goods Inventory

Work In Process Wip Inventory Youtube

Manufacturing Account Format Double Entry Bookkeeping